The Way Smartphones Change Our Way

Did you ever think about changes of the way we shop because of technologies? Well, we at Gagadget did. Those who own smartphones and do not dodge new opportunities has entered a whole new world. I’m not kidding. You can now purchase any unusual and far distant thing much easier than cook spaghetti. Well, those who cook spaghetti will soon notice that their smartphone, internet and mobile apps help them shopping. Even if you are just going to start using new services and opportunities we will talk in this article, trust us, the day you will not imagine your everyday life without them is approaching. So, read and prepare!

Good Choice of Goods Via Apps

Some time ago I was paying my purchase in internet shop with my smartphone. At the moment I thought “Here you are, I’m going to send my money to an unknown and maybe non-existing man for a thing that may even not exist, or it is not as described”. In the modern consumer society any distant purchase in a shop far far away but with good reputation is more protected than shopping locally. An internet shop owner who sold a bad product would have a little chance to restate his reputation while a guy at agricultural market can just move to another one. Internet can not help you to spread your comments about that market seller to wide public. In the internet market hundreds, thousands and millions buyers would switch to competitors forever, so selling a bad product does not pay.

If you have a smartphone, wear cloth, purchase electronic devices, books and so on and don’t own any shopping app, there is something wrong with you. With your smartphone you can make purchases quickly and easily as you can compare products with other offers, go through a range of products without the need to go to a store.

Even if you’re going to visit a real shop to buy cloth or electronics, it is worth to check the range online and maybe find something mind catching. It is a very good idea before shopping abroad if you know brand you are interested in. Many of them have their own mobile apps available. Those who don’t have at least their sites set up to work with mobile browsers. You can easily browse tons of new collections of H&M or COS while on your way to an airport and not spend tons of hours and get tired while investigating stores and stores and stores floor by floor by floor. Especially if the country you’re going to visit is worth to sightseeing. Let’s keep in mind we are not that rich to spend our life for offline browsing through things instead of enjoying what’s around. Time is valuable resource while mobile traffic isn’t. Prices for electronic devices may deviate a lot from store to store. And not all things available worldwide are available locally. There are products worth to buy in the USA, China, Europe or neighboring countries. I tried it once and now feel lost in an ordinary offline shop. I see a cloth I like and it fits well, but maybe there are better and cheaper clothes in internet? I don’t know about you but I personally prefer to make an impulse purchase with my smartphone not seeing it alive in a shop.

What am I going to say? Oh, well, shopping in internet (and also through mobile apps) save you time and money.

Virtual Payment Cards

If you feel at home while shopping in internet the next step to do is to make your payments secure. Of course you can pay with your ordinary credit card where you used to receive your salary and keep your savings. Are you smart? Is it a good idea in our virtual times? Not at all. Many banks now issue so-called virtual cards and often do it free of charge or for a small fee. A card of the kind exists only in internet not as a real card. Such a virtual card has its own financial details. Even if someone steals the details you have a little chance to loose your money. The case is you used to send money in needed sum to that card from your main account only before the very purchase.

Besides the known security benefits, a virtual bank card can help meeting other tasks. IN my recent article I talked about QIWI wallet I discovered while being on my long stay trip to Russian Federation. I didn’t have a local card, of course, but I need to pay my mobile bills and make some minor purchases in internet. And you need some cash on local currency anyway. It is better to own a local card. To get a virtual Visa card with your QIWI wallet you only need to download an app and bind your mobile phone to your QIWI account. You can recharge your new virtual card from you bank account or via payment terminals you an find anywhere in the town. Well , it is generally quite hard to find a terminal without surcharge. But it is anyway a great option to get a local payment card right in your smartphone not being a local citizen and not going to a local bank, all those time wasting and form fillings. And you can order a real plastic card to use in offline shops, it does not cost that much and you can withdraw money from cash machines. The surcharge for all transactions is very reasonable and is almost the same as to transfer money from your QIWI account to your bank one. And you do not need to have any relation with the bank. By the way, you can use VISA PayWave if your smartphone has NFC.

MasterCard is also active in the field of virtual cards. The Russian market is of great interest to both providers, so some innovations first appear here. MasterCard offers three technologies for virtual payment cards and all three area available in Russia:

- SIM-centric;

- embedded Secure Element, eSE, for mobile phones;

- cloud-based Host Card Emulation, HCE.

SIM-based technology is offered by Russian mobile providers (MTS was the first but now all of them offer this kind of service). The second technology had been offered by Tinkoff Bank with their wallet app for Russian editions of Sony, HTC and Philips smartphones. It helped to issue MasterCard remotely. Then the Russkiy Standart bank did the same with Samsung smartphones. The previous two technologies are nto that interesting as the latter one which can capture mass market soon. It easily helps to issue virtual cards right from your Android 4.4+ smartphone.

The new technology of issuing virtual cards is now adopted by many innovative banks, electronic payment systems (QIWI with VISA and Yandex.Money and WebMoney with MasterCard), and even mobile providers. It seems to me virtual cards will be offered by anyone in that country including shoe dealers and ice cream makers. Considering the size of that country and certain characteristics it possesses, all those innovations are good for innovative people with transportation problems around, especially because many services do not require passport authentification. It is so nice to have all financial benefits of a resident not being a resident and in fact make payments with your smartphone anonymously.

There is an example of virtual cards from Tele2. If you do still not understand what I’m talking about the video will help you to get the idea.

We can make two conclusion at this point. First, you do not need to bother of security problems as banks and intermediary organizations will help you free or almost free at their best. Second, as virtual cards and internet payments become in use wider and wider, as non-contact terminals and smart NFC electronics are more and more accessible, the role of banks shrinks and can become obsolete in future. Only organizations providing user friendly interfaces with maximal range of services will survive. And banks may not be a part of the success.

Fingerprint Mobile Payment Protection

At the moment it is used rather PIN code protection. But soon it will be fingerprints. Right now only iPhones provide the option with TouchID. Android-based phones use fingerprint only for show off. During presentation of Android 6.0 guys from Google announced fingerprint protection of purchases in Google Play. Once it will be generally available along with smartphones with scanners many popular apps for shopping and banking will add this option and the new era of mobile payments will come. Fingerprint is fast (no need to wait for an SMS message and input it manually) and reliable (hopefully you family will not use your fingers to purchase something desirable while you sleep). 30 seconds maximum to recharge your account and under 1 minute to buy train ticket with iPhone 6 and a booking app. It is really cool.

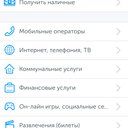

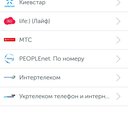

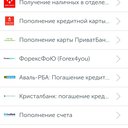

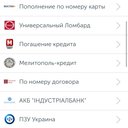

Purchasing Non-Bank Services with Bank Apps

Online banking of the most innovative banks starts looking like a town market where you can buy virtually anything for almost nothing. Mobile bills, rent payment, tickets, money transfers abroad, whatever. And regular payments as well! Having this kind of services at hand makes it easy to make payments for this and that. Not so far ago any payment task was associated with headache and queues. Now you can pay easily using various services with similar offers.

Keeping Discount and Saving Cards in a Smartphone App, not in your Wallet

I followed every news about projects offering several discount and savings cards in a single one. I’ve been waiting for a solution because the pocket size of my wallet with all money and discount cards is awful now. At last services of the kind started appearing. For instance, CardKit is an application for smartphones (available for both iOS and Android) that can store cards and consult you considering your geographic location.

Similar functionality was recently added to the Privat24 application from Privatbank

So we have to wait only for store to issue their discount cards in electronic form.

Ticket purchasing without needs to print hardcopies

Well, to go to cinema or to go by train is much simpler these days than ever before. Even air travels are more comfortable thanking to mobile application storing your boarding passes. Why you need a bunch of papers in your pockets if you have a small yet handy computer able to output any image on its screen at any time? Moreover, the use of electronic “papers” just saves time and make entertainment services easier-to-go for those who use to be hard to split from their beloved chairs. And environment, of course, counts.

Call and Payment for Taxi without a Human Operator Involved

Little town habitants are still to discover all these nice things while megapolisers can use special applications (or web services) to find a taxi easily not talking to taxi customer care or being looking for phone numbers to call one. In Kiev we have Uklon and recent addition to Privat24 application. But the World is dominated by Uber. Blablacar makes travels more affordable and easy to find in 20 countries. Actually to go travel is as easy now as never before – some money and your ID and that’s all, the World is before you. Some services even bill you automatically upon a service work is complete.

Service Payments Right from Your Phone

In Ukraine it is not yet as good as should be, but in many countries it works just perfect.

In Ukraine you can use Kyivstar appplication “Mobile Money”. You can buy certain services via the app and pay for it with you mobile balance. The operator states they have 50,000 users per month and 680,000 (or 2.5%) users in general. Volume of transactions of this type grows 10% per month. Considering ARPU in Ukraine is quite low we can think it is a good result. Ukraine still is at the very beginning in use of this type of payments as general business environment is not that good.

The Mobile Money app from Kyivstar is not unique, of course. In Czech Republic you can pay for public transport. ALl you need is just to send a SMS to a certain number. In return you get a ticket code with time stamp (you pay for time in transport in Czechia, not for distance or trips). The payment billed to your mobile account. I would be really glad if we would have this kind of service.

Russian MTS offers their Easy Payment service. The main difference from the service of Kyivstar is users can bind their credit card to their mobile phones and pay with the card not with the mobile account. So you have a more flexible instrument that is more handy than SWIFT or wire transfer. All you need to send money is just a phone number of your addressee. No need to go to a bank or get cash from an ATM. You can pay you rent, insurance, buy tickets and so on. Actually it is the same service as internet banking: you need only your money, mobile account and ID data. The only difference the intermediary entity is not a bank or agency, but your mobile service provider.

Payments Through NFC Bound to Your Bank Card

Today you can use a smartphone, watch, pendant or something else. There is some infrastructure available from various payment systems. You can use it like MasterCard PayPass or any other contactless device. You can pay for public transport this way. It works now in 5 cities in the World. It is not a problem now to find a a contactless payment terminal. It is only a question of communications between your devices and bank software. We don’t have here all those Apple Pay, Samsung Pay, Android Pay, banks try to do their best to put this kind of systems into operation. On the other hand there are not so many NFC enabled devices yet. Say, Privatbank states ther Privat24 app is sued by 2 million users with NFC enabled smartphones and it is under 5% of Ukrainian population. And we have to admit Privatbank is the biggest bank in the country with good network and the most popular app.

As I’ve written before today payment systems like VISA and MasterCard can issue virtual cards right to your smartphone. Actually NFC should be widely used. NFC can be built in smart watches and wristbands (and wristbands are much much cheaper than smartphones). But wristband manufacturers do not build in NFC yet. Some watch manufacturers do. In Ukraine Alpha Bank issued so called Alpha Watch with MasterCard PayPass technology. In Russia MasterCard is promoting their system for parents to control kids in schools. QIWI offers VISA PayWave functionality. But all this does not occur everywhere. But I personally believe smartphones and other mobile devices will make plastic cards obsolete.